RiskPe Sales Dashboard: Building BI from Scratch

Develop MVP predictive models for sustainability startups.

💡

I am working on anonymizing the data with the consent of the company to present the complete project on github. Stay tuned!

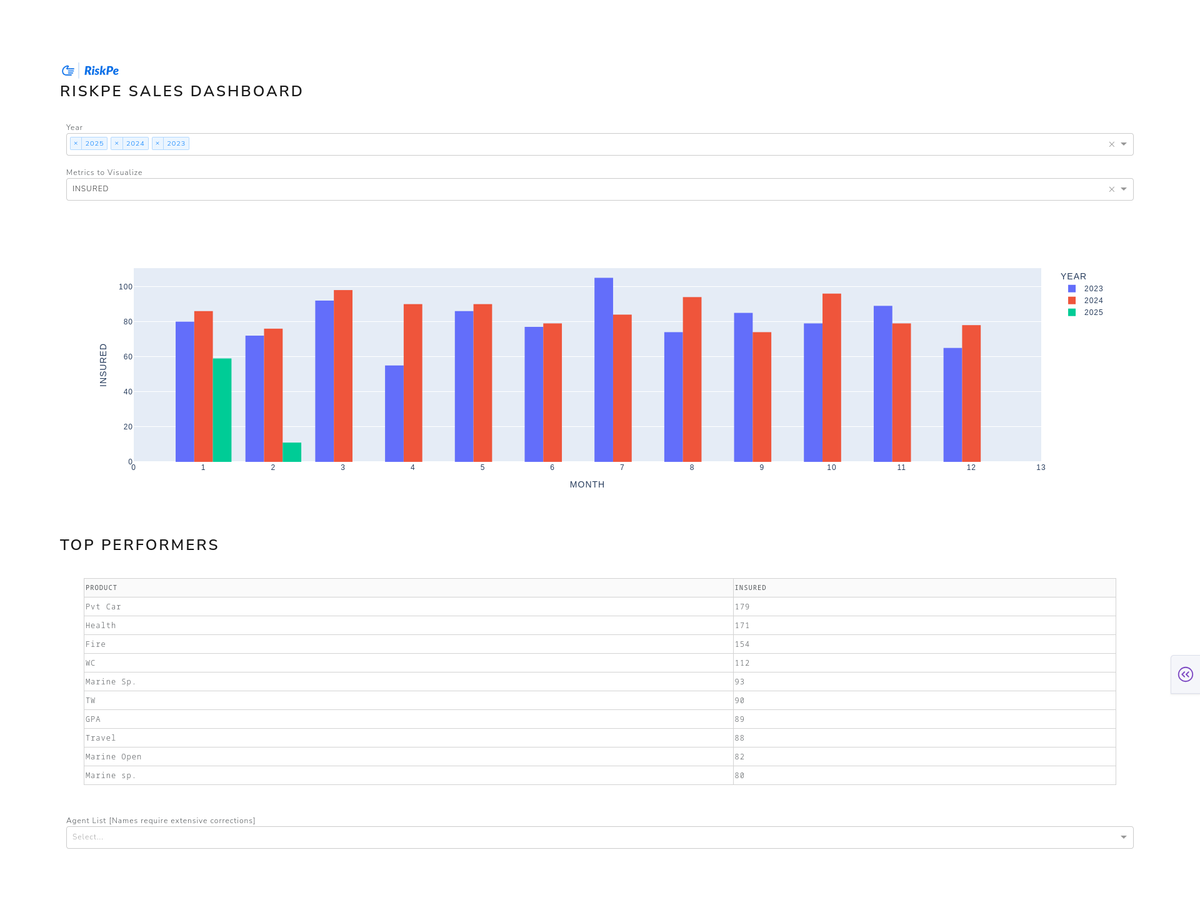

RiskPe Sales Dashboard

Internal Analytics Tool | Python, Plotly | Insurance Business Intelligence

As part of my work at RiskPe, an early-stage insurance startup, I am developing a sales dashboard to provide the founding team and key stakeholders with real-time visibility into business performance. The goal was to move beyond ad-hoc spreadsheets and create a centralized, visually clear analytics layer to inform strategy and operations.

Business Objective

In a fast-moving startup environment, decisions need to be data-backed but fast. This dashboard helps RiskPe:

- Track month-over-month and year-over-year sales performance

- Spot emerging trends and seasonal shifts

- Identify the most successful insurance products and potential areas for optimization

Key Features

- Multi-Year Sales Comparison

Bar charts show insured counts across 2023–2025, helping identify trends and performance spikes. - Top-Performing Products Table

Clearly surfaces the highest-selling insurance products, such as Pvt Car, Health, and Fire. - Metric Flexibility (Planned)

Users will be able to toggle between different KPIs like revenue, claims, and growth rate. - Executive Summary Generator (In Progress)

This tool will generate automatic, natural-language summaries of key insights to make the dashboard more accessible for non-technical decision-makers. - Data Quality Notes

Agent names are flagged for correction—reflecting the team’s iterative approach to improving data hygiene while maintaining agility.

Technical Highlights

- Built using Plotly Express for high-quality visualizations

- Structured for deployment in Dash or lightweight web apps in the future

- Uses Pandas for transformation and aggregation of time-series insurance data

- Optimized for readability and quick business takeaways

To-Do / Roadmap

The dashboard is designed to evolve iteratively. Here's what’s next:

| Task | Priority | Description |

|---|---|---|

| Implement dynamic filters by agent and product | High | Enable real-time drill-down for deeper analysis |

| Add additional metrics (Revenue, Claims, Growth Rate) | High | Expand the dashboard's analytical scope |

| Build and integrate the Executive Summary Generator | High | Automate the creation of plain-language business insights |

| Introduce region-wise sales heatmap | Medium | Add geographic analysis capability |

| Connect to real-time or automated data sources (e.g., SQLite, API) | Medium | Make the dashboard fully dynamic and scalable |

| Clean up inconsistencies in agent name data | Low | Improve reliability and data quality over time |

| Deploy dashboard using Dash or Flask | Low | Make the tool accessible via web and mobile devices |